net operating working capital definition

All amounts are in USD in million. This is because a large amount of debt actually reduces the amount of.

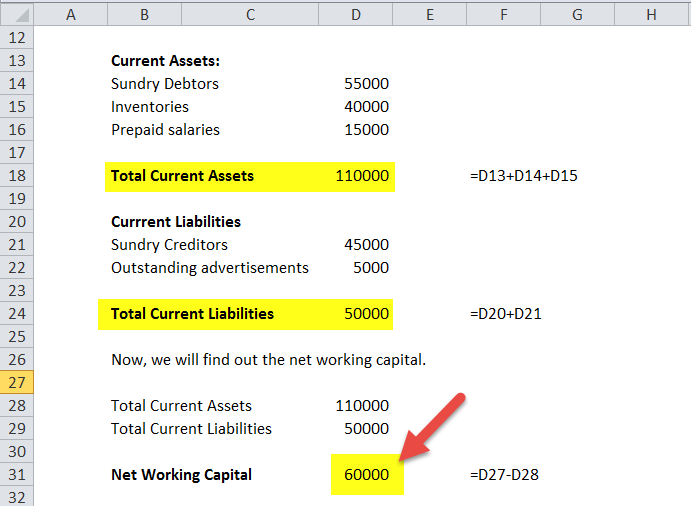

Working Capital Formula And Calculation Exercise Excel Template

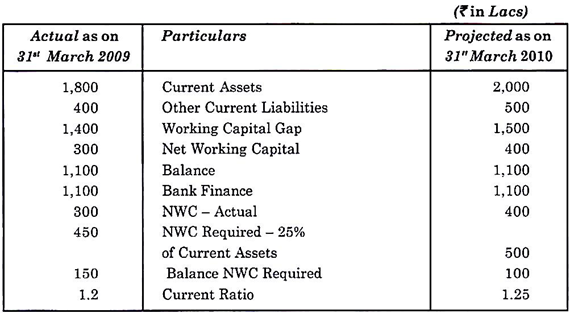

The concept of operating working capital is a beneficial measuring stick for newer businesses which often accrue large amounts of short-term debt in an attempt to get the business off the ground.

. The net operating capital is 275. Total Net Operating Capital Net Operating Working Capital Non-current Operating Assets. Calculate total net operating capital for Best Buy Inc.

Net working capital 190000 - 27000 163000. Now calculating net working capital is super simple. Estimated Net Working Capital has the meaning set forth in Section 24a.

Net Operating Working Capital Operating Current Assets Operating Current Liabilities. Net operating working capital is a direct measure of a companys liquidity operational efficiency and its overall financial health at least in the short-term. At the very top of the working capital schedule reference sales and cost of goods sold from the income statement for all relevant periods.

Net working capital represents the cash and other current assetsafter covering liabilitiesthat a company has to invest in operating and growing its business. The latter relates only to current assets and current liabilities. These will be used later to calculate drivers to forecast the working capital accounts.

It is used to measure the short-term liquidity of a business and can also be used to obtain a general impression of the ability of company management to utilize assets in. Net operating working capital is different from net working capital. Estimated Working Capital has the meaning set forth in Section 23a.

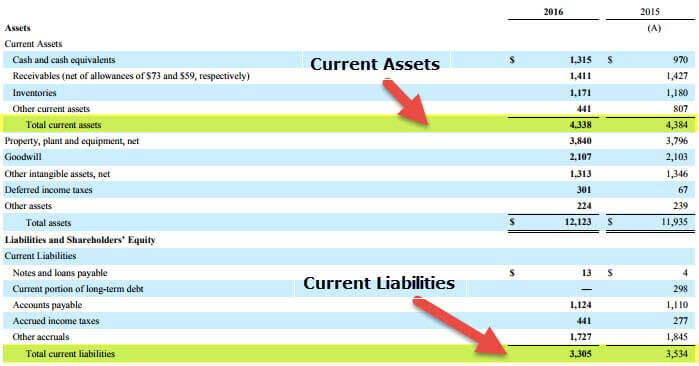

Current liabilities 1500080004000 27000. BBY using the following balance sheets. Working capital is the key criterion for the financial stability of any.

Net Working Capital means at any date a the consolidated current assets of Holdings the Borrower and its consolidated Subsidiaries as of such date excluding cash. Operating working capital or OWC is the measure of liquidity in a business. Net working capital is calculated using line items from a businesss balance sheet.

Net working capital is the aggregate amount of all current assets and current liabilities. Net working capital is the difference between a businesss current assets and its current liabilities. Short-term debt actually works in a companys favor when calculating the OWC.

Operating working capital focuses more on day-to-day operations whereas net working capital looks at all assets and liabilities. Net operating capital is different from net working capital. Operating working capital is defined as operating current assets less operating current liabilities.

Net working capital is more comprehensive because it represents the cash and other current assets a company has to invest in operating and. Net working capital example. Working capital is the main criterion for the financial.

The longer this cycle the longer a business is tying up capital in its working capital without earning a. Operating represents assets or liabilities which are used in the day-to-day operations of the business or if they are not interest-bearing financial. We have already defined working capital as current assets minus current liabilities.

To calculate the total current assets you need to. Net Working Capital Current Assets Current Liabilities 49433M 43625M 5808 million. With most transactions the company is acquired on a cash-free debt-free basis whereas cash and debt will not be assumed by a buyer at close but rather retained by the seller.

Therefore it excludes long-term depts and includes marketable securities and short-term accounts receivable. Net Working Capital Definition. Net working capital or NWC is the result of all assets held by a company minus all outstanding liabilities.

Operating working capital is all assets minus cash and securities minus all short term non-interest debts. The working capital cycle WCC also known as the cash conversion cycle is the amount of time it takes to turn the net current assets and current liabilities into cash. Heres how to calculate net working capital how to.

Sum of all these will give us the total current liabilities that we will consider to calculate NWC net working capital. Therefore in most MA transactions net working. Generally the larger your net working capital balance is the more likely it is that your company can cover its current obligations.

Operating working capital is a narrower measure than net working capital. Low working capital and low net operating working capital together with unfavorable current ratio quick ratio days sales in receivable and. Working capital turnover is a measurement comparing the depletion of working capital used to fund operations and purchase inventory which is then converted into sales revenue for the company.

Related to Estimated Net Operating Working Capital. In other words it represents that funds an entity has to cover short-term obligations such as payroll rent and utility bills. Now that you understand the equation and what common types of current assets and liabilities are here is an example of how the NWC ratio works.

March 28 2019. Simply subtract the total current assets and current liabilities. It therefore excludes long-term divisions and includes marketable securities and short-term accounts receivable.

Companies that have a large amount of NOWC versus their liabilities and accruals demonstrate that they have the potential to grow over time and also make investments if necessary. Say that your company has cash that equals 25000 accounts receivable of 10000 and total inventories worth 20000. Working capital is calculated as.

Under sales and cost of goods sold lay out the relevant balance sheet accounts. The second one is about only current assets and current liabilities. Net operating working capital is 275.

Net Operating Working Capital Operating Current Assets Operating Current Liabilities 30678M 34444M -3766 million. Working capital is a measure of both a companys efficiency and its short-term financial health. Cash and other financial assets are typically excluded from operating current assets and debt.

Net Working Capital Definition Formula How To Calculate

Working Capital Formula And Calculation Exercise Excel Template

How Do Net Income And Operating Cash Flow Differ

Working Capital Formula And Calculation Exercise Excel Template

Operating Leverage Formula And Excel Calculator

Net Working Capital Definition Formula How To Calculate

Net Working Capital Formula Calculator Excel Template

What Is Working Capital Meaning Definition Formula Management Net Working Capital And Example

What Is Net Working Capital How To Calculate Nwc Formula

Net Working Capital Formula Calculator Excel Template

Difference Between Fixed Capital And Working Capital Top 8 Differences

Net Working Capital Definition Formula How To Calculate

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Meaning Formula Calculation

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)